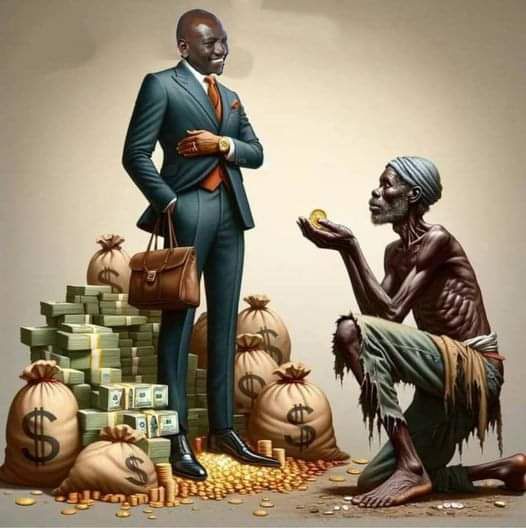

Increasing Taxation on a Poor Nation will just increase Malnutrition and Disease Rates.

Today, let’s discuss an issue that strikes at the very core of our society—the impact of the ongoing protests, coupled with rampant corruption, nepotism, and poor governance, on the nutrition and health status of Kenyans. The current regime under President Ruto has not only failed to address these issues but has exacerbated them, threatening the wellbeing of our nation and our ability to achieve Sustainable Development Goal 3 (SDG 3), which aims to ensure healthy lives and promote wellbeing for all at all ages.

The Financial Bill 2024: A Catalyst for Increased Poverty

The proposed Financial Bill 2024, set to increase various taxes and duties, will have far-reaching consequences. The bill, as outlined in the Kenya Gazette Supplement No. 102, introduces changes to income tax, digital marketplace regulations, and other financial statutes(finance-bill-2024). These changes are poised to increase the cost of living, pushing more Kenyans into poverty. The increased cost of farm inputs will adversely affect agricultural production, leading to higher food prices and reduced access to nutritious food.

Impact on Triple Burden of Malnutrition

Kenya is already grappling with the triple burden of malnutrition—undernutrition, micronutrient deficiencies, and overnutrition. The financial strain imposed by the new taxes will exacerbate these issues:

- Undernutrition: Families struggling to afford basic necessities will cut down on food expenses, leading to inadequate dietary intake, particularly for vulnerable groups like children and pregnant women.

- Micronutrient Deficiencies: The high cost of diverse and nutritious foods such as fruits, vegetables, and animal products will lead to increased deficiencies in essential vitamins and minerals, affecting physical and cognitive development.

- Overnutrition: Conversely, the affordability of unhealthy, calorie-dense, and nutrient-poor foods will lead to rising cases of obesity and related non-communicable diseases (NCDs) such as diabetes and hypertension.

Corruption and Embezzlement: Hindering Health and Nutrition Services

Corruption and embezzlement of public funds have deeply eroded the quality of health and nutrition services in Kenya. Resources meant for healthcare infrastructure, medical supplies, and nutritional programs are siphoned off by corrupt officials. This mismanagement has led to:

- Poor Health Services: Inadequate medical supplies and poorly maintained health facilities hinder access to quality healthcare.

- Limited Nutrition Programs: Essential nutrition interventions, such as supplementation and school feeding programs, are underfunded and poorly implemented.

Human Rights Violations and Democratic Rights

The excessive use of force against unarmed protesters by the current regime is a blatant violation of human rights. Article 37 of the Kenyan Constitution guarantees every citizen the right to peaceful assembly, demonstration, picketing, and petition(finance-bill-2024). The violent suppression of these rights has led to loss of life and property, creating an environment of fear and instability.

Condemnation of Killings and Human Rights Violations

We must unequivocally condemn the killings and human rights violations perpetrated by the state against innocent protesters. These actions not only contravene the Constitution but also undermine the principles of democracy and justice. It is imperative that we hold those responsible accountable and demand respect for human rights and the rule of law.

Conclusion: Impact on SDG 3

The cumulative effect of the ongoing protests, corruption, and poor governance is a significant barrier to achieving SDG 3. Ensuring healthy lives and promoting wellbeing for all requires a stable, transparent, and accountable government that prioritizes the health and nutrition of its citizens.

As we move forward, let us advocate for policies that promote economic stability, fight corruption, and uphold human rights. Only then can we hope to build a healthier, more prosperous Kenya.

Thank you.

Here are the sources referenced in the script:

- Financial Bill 2024: Information regarding the changes introduced by the Financial Bill 2024 is taken from the Kenya Gazette Supplement No. 102, which details the proposed amendments to income tax, digital marketplace regulations, and other financial statutes.

- Kenyan Constitution: Article 37 of the Kenyan Constitution guarantees every citizen the right to peaceful assembly, demonstration, picketing, and petition.

- Sustainable Development Goals (SDG 3): The SDG 3 goal is to ensure healthy lives and promote wellbeing for all at all ages, which can be found in the United Nations’ documentation on the Sustainable Development Goals.

- Human Rights Violations: Reports and documentation on the excessive use of force against protesters and human rights violations by the current regime can be sourced from various human rights organizations, such as Amnesty International and Human Rights Watch.

Here are the relevant details extracted from the Finance Bill 2024 document:

Sources

- Income Tax Changes:

- The Finance Bill 2024 proposes several amendments to the Income Tax Act. Notably, a new tax called the Significant Economic Presence Tax will be applied to non-resident persons earning income through digital marketplaces. This tax is set at a rate deemed to be 20% of the gross turnover derived from the digital marketplace(finance-bill-2024).

- Digital Marketplace:

- The bill defines a digital platform and mandates that payments made or services by owners or operators of digital marketplaces will be considered as income accrued or derived from Kenya(finance-bill-2024).

- Agricultural Inputs:

- Several amendments target the agriculture sector, including the exemption of inputs and raw materials used in the manufacture of mosquito repellents, tea packaging material, micronutrients, foliar feeds, and bio-stimulants from taxes. This also includes inputs and raw materials supplied to manufacturers of agricultural pest control products upon the recommendation of the Cabinet Secretary for Agriculture(finance-bill-2024).

- Healthcare:

The bill also proposes amendments that impact healthcare by exempting certain inputs and raw materials from taxes, thus potentially affecting the cost of healthcare products and services(finance-bill-2024). - Miscellaneous Amendments:

Other notable amendments include changes to the Value Added Tax (VAT) Act, which will impact a range of products and services, including locally assembled and manufactured mobile phones, motorcycles, electric bicycles, and bioethanol vapor stoves(finance-bill-2024).

Leave a comment